Your Roadmap to a Thriving M&A: Strategies for a Seamless Transition and Lasting Legacy

Executive Summary

You've built something truly special, and the thought of selling brings both anticipation and apprehension. We’ve acknowledged the profound impact of cultural clashes and the silent drain of talent. Now, it's time for the ultimate roadmap. This article provides you with actionable strategies to build resilience in your organization, from proactive cultural due diligence to safeguarding invaluable knowledge. We'll also equip you to advocate for the human element with your other trusted advisors. By prioritizing people, you ensure a smoother transition, protect your legacy, secure your earn-out, and create a stronger, more resilient future for the company you've poured your life into.

You’ve built something remarkable, something that is more than just a business; it’s a living entity, infused with your values and the dedication of your team. We’ve acknowledged the profound impact of cultural clashes and the silent drain of talent that can threaten your company’s very soul during an M&A. It’s a lot to consider, isn't it? But here’s the good news: while the challenges are real, so are the solutions! It’s time to move from understanding the risks to embracing the roadmap for success.

The overwhelming evidence demonstrates that the ultimate success of mergers and acquisitions is profoundly dependent on how effectively the human element is managed and integrated. The high failure rates of M&A deals, largely attributed to cultural clashes and people-related challenges, underscore that the "soft" aspects of human capital are, in fact, the "hard" determinants of long-term value creation [1, 2]. Companies effectively managing culture are "50 percent more likely to meet or exceed their synergy targets" [3]. This isn’t just about making people happy; it’s a direct, quantifiable driver of value creation and a competitive advantage.

I. Bridging the Gap: Talking to Your Trusted Advisors

You rely on your lawyer and your accountant. They're experts in their fields, focused on the financial and legal intricacies of the deal. But as you've keenly observed, they might not always prioritize the "people side" of M&A [4]. They might see human capital integration as an "extra expense" rather than a critical investment. So, how do you help them understand why this "soft stuff" is so vital?

Here's how you can talk to your financial and legal advisors about the indispensable value of human capital integration, and why bringing in specialists is not an expense, but a strategic imperative:

- Frame it as Risk Mitigation:

"Look, I know you're focused on mitigating legal and financial risks, and I appreciate that. But there's a massive risk that often gets overlooked: cultural clashes and talent loss. Studies show 70-90% of M&A deals fail to meet their objectives, and cultural issues are a leading cause [1, 2, 5, 6, 7]. Losing key employees isn't just a morale issue; it's a direct hit to productivity, customer relationships, and our ability to realize the very synergies we're paying for [8, 9]. Investing in human capital integration is like buying insurance against these risks.

- "Connect to Value Realization (and Your Earn-Out): "You've helped me structure this deal with an earn-out, which means my final payout is tied to the company's post-merger performance [4]. If our people are disengaged, if key talent leaves, or if the cultures clash, that directly impacts productivity, sales, and ultimately, whether those earn-out targets are met [8, 9]. Bringing in experts to manage the human side isn't just about 'being nice'; it's about protecting and maximizing the financial value of this deal, for me and for the buyer."

- Highlight the "Hidden Costs" of Turnover: "You understand the cost of a bad contract or a missed financial detail. But have you considered the hidden costs of employee turnover? Replacing a key employee can cost 0.5 to 2 times their annual salary, not to mention lost productivity, damaged customer relationships, and the loss of invaluable 'know-how' that isn't written down anywhere [8, 9]. These are real financial impacts that can derail the entire acquisition. A proactive human capital strategy prevents these drains."

- Emphasize Specialization: "Just as I wouldn't ask you to handle the operational details of manufacturing, I wouldn't ask the buyer's finance team to manage complex cultural integration. This is a specialized field. Firms like The Pillars bring expertise in organizational development and change management specifically tailored to M&A. They complement your work by focusing on the human element that underpins all the financial and legal aspects."

- It's About Long-Term Success: "This isn't just about getting the deal done; it's about setting the combined company up for long-term success. A well-integrated culture leads to higher employee engagement, better performance, and sustained growth [1, 10]. That's what makes this acquisition truly valuable, far beyond the closing date."

By framing the conversation around risk mitigation, value realization, and specialized expertise, you can help your advisors see human capital integration not as an "extra expense," but as an essential investment that protects the deal and ensures its long-term success.

II. Building Resilience: Strategies for a Human-Centric M&A Integration

Given the high failure rates and profound human costs associated with cultural clashes, employee turnover, and tacit knowledge loss, a proactive, human-centric approach to M&A integration isn't just advisable; it's absolutely essential for achieving sustained value creation and securing your earn-out.

The overwhelming evidence of M&A failures [1, 2, 5, 6, 7] and the substantial financial costs of employee turnover and knowledge loss [8, 9] clearly demonstrate that neglecting the human element leads to massive financial detriment. Conversely, research shows that companies effectively managing culture are "50 percent more likely to meet or exceed their synergy targets" [3].

This indicates that investing in cultural due diligence, transparent communication, and robust talent/knowledge retention isn't merely a risk-mitigation strategy or a "nice-to-have" HR function; it's a direct, quantifiable driver of value creation and a competitive advantage.

This means M&A strategies must fundamentally reframe human capital management from a reactive cost center to a proactive, strategic imperative that directly contributes to the deal's financial success and long-term viability.

This necessitates allocating significant resources, leadership attention, and time to these "soft" areas from the very inception of the M&A process, recognizing them as critical investments rather than discretionary expenses.

Prioritizing Cultural Due Diligence and Integration Planning

- Early Assessment: It's crucial to assess the culture of each business before the deal is struck. Companies are "often surprised by the results of cultural due diligence" [1, 4]. This involves identifying shared values and differences [1, 10] but it's important not to exaggerate differences or categorize them as "good" versus "bad" cultures, as both can have unique strengths that can be leveraged [3, 10].

- Dedicated Integration Team: Establish a dedicated integration team to oversee cultural alignment from the outset [1, 10]. This team should be empowered with resources and a critical role in achieving integration goals, ensuring that cultural considerations are not an afterthought [2, 10].

- Defining New Culture: Define a set of desirable cultural attributes for the new, combined entity [2, 10] and articulate a clear "change story" to plot the desired cultural transformation [3, 10]. This program must be interwoven with all integration initiatives and resonate with people on a personal level, requiring both rational and emotional engagement throughout the change management process [3, 10].

- HR's Strategic Role: Human Resources plays a crucial role in mitigating cultural risks and building cohesion and clarity post-deal [1, 11]. HR professionals are uniquely positioned to assess cultural compatibility, facilitate communication, and design retention strategies [1, 11].

Transparent Communication and Employee Engagement

- Open and Consistent Dialogue: Companies must communicate openly, honestly, and consistently throughout the M&A process [1, 10, 12]. This includes providing regular updates through town halls, emails, and Q&A sessions, ensuring employees feel informed rather than left in the dark [1, 10, 12].

- Overcommunication: Overcommunicating early and often is vital, as employees tend to fear uncertainty more than change itself [1, 10]. Setting expectations with a clear timeline of what is changing and when is key to alleviating anxiety and preventing rumors from taking hold [12, 13].

- Two-Way Feedback: Create an ongoing dialogue that allows employees to ask questions and voice concerns [1, 10, 12, 14]. Actively listen to employee feedback through surveys, feedback meetings, and one-on-one check-ins, and crucially, act on that feedback to reassure employees their voices matter and that their input is valued [1, 10, 12, 14].

- Building Trust: Transparent communication helps build trust and provides clear guidance, making employees feel more secure and committed to the new organization [1, 10, 12]. This trust is foundational for successful integration.

The research consistently highlights a complex, interdependent relationship between cultural clashes, communication breakdowns, and challenges in knowledge transfer. For instance, cultural differences [1, 10, 15] can lead to trust issues [1, 10, 15], which in turn make employees reluctant to share valuable knowledge [1, 16].

Poor or inconsistent communication [1, 10, 12, 14] fuels uncertainty, prompting employees to hoard information for perceived job security [1, 16]. This implies that these issues are not isolated problems to be solved independently but are deeply interwoven.

Effective M&A integration, therefore, requires a holistic and integrated approach. Solutions must address the "people, process, culture, and enabling technologies" [17] in concert.

Strategic Talent Retention and Knowledge Management Initiatives

Talent Retention:

- Job Security and Roles: Provide reassurance about job security and roles [1, 12]. Be honest about potential restructuring and offer supportive transition plans, such as severance or outplacement services, if layoffs are unavoidable [1, 12]. Clarify new expectations, responsibilities, and career development opportunities for remaining employees [1, 10, 12, 18, 19]. People need to know where they stand to do their best work [1, 12].

- Cultural Reinforcement: Reinforce company culture and values by focusing on shared values, involving employees in deciding which cultural aspects stay and evolve, and maintaining popular aspects of each culture to make the change feel more inclusive [1, 12]. Leaders should lead by example and embody the new culture [1, 10, 20].

- Incentives and Development: Implement structured retention programs, including bonuses, career development opportunities, and clear role expectations, to reduce uncertainty and instill confidence [1, 10, 12, 18, 19, 21]. Recognize employees for their efforts, as this significantly increases engagement and reduces turnover [1, 10, 21].

- Managerial Preparedness: Equip managers with essential change management skills to effectively address employee concerns and guide their teams through the transition [1, 10, 22].

Knowledge Management:

- Knowledge Audit: Begin any knowledge transfer plan with a thorough knowledge audit to inventory existing knowledge assets, identify where they are stored, who has access, and where gaps exist [1, 16]. This initial step is critical for understanding what knowledge is at risk.

- Proactive Documentation: Businesses must proactively encourage their people to document their knowledge and make it easy to do so, preventing the loss of valuable information, especially when key people leave [1, 16]. This shifts reliance from individual memory to accessible organizational knowledge.

- Tacit Knowledge Transfer Methods: Explore creative methods for transferring tacit knowledge, such as structured training sessions, informational interviews, and mentorship programs [1, 16, 17, 23]. Fostering a culture of continuous learning and knowledge sharing is a top priority, ensuring that experiential knowledge is passed on effectively [1, 23].

- Systems and Culture: Invest in structured knowledge acquisition processes and knowledge management systems [1, 23]. Simultaneously, address employee resistance to sharing knowledge by creating an environment where employees feel valued, secure, and incentivized to contribute their expertise [1, 16, 23].

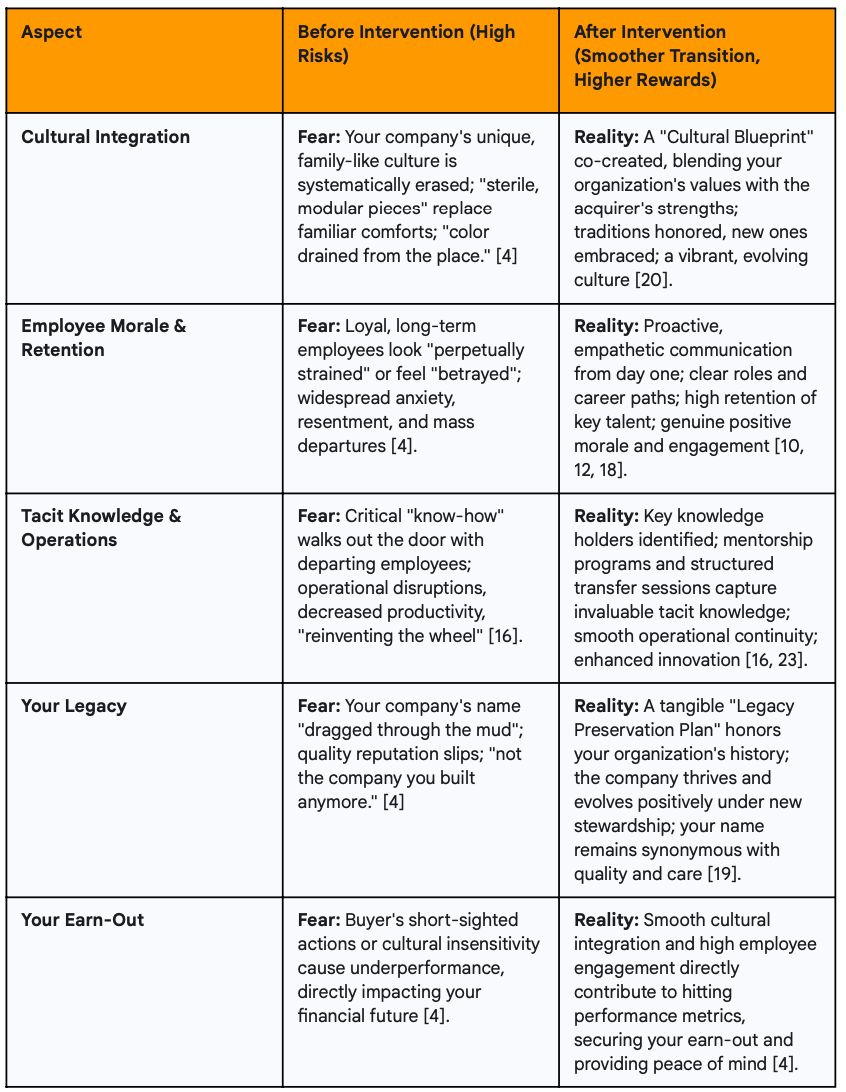

III. Your Company: Before & After Intervention

Let's visualize the impact. This isn't just about abstract concepts; it's about the tangible difference a human-centric approach can make for your company.

IV. Conclusion: Prioritizing People for Lasting SMB Success

While the initial allure of mergers and acquisitions is often rooted in financial synergies and market expansion, the overwhelming evidence demonstrates that their ultimate success is profoundly dependent on how effectively the human element is managed and integrated [1, 10]. The high failure rates of M&A deals, largely attributed to cultural clashes and people-related challenges, underscore that the "soft" aspects of human capital are, in fact, the "hard" determinants of long-term value creation.

The "fear of cultural clashes and loss of company identity," as personified by your profound concern for long-term employees, is not merely an emotional or sentimental issue. It represents a critical business risk with tangible financial and operational consequences.

The loss of your company's "soul" directly translates into employee turnover, the silent drain of invaluable tacit knowledge, decreased productivity, damaged customer relationships, and significant financial setbacks. Ignoring these human fears is to ignore the very foundation upon which a successful integration is built.

M&A processes inherently introduce significant stress and uncertainty for employees [1, 10], demanding rapid adaptation to monumental changes [1, 18]. The success of integration, therefore, becomes a direct reflection of how effectively people are managed [1, 11] and the extent to which leaders can equip managers with crucial change management skills [1, 10, 22].

This implies that M&A isn't just a financial transaction but a profound organizational stress test that reveals the true capabilities of an organization's leadership in fostering adaptability, building resilience, and demonstrating genuine empathy towards its workforce.

The manner in which an organization navigates the human challenges of M&A serves as a powerful indicator of its overall organizational health and future resilience in a dynamic business landscape. Leaders who fail to prioritize the human aspect risk not only a failed deal but also a long-term erosion of trust, a sustained talent drain, and ultimately, a compromised organizational viability.

To navigate the complexities of M&A successfully, you must adopt a human-centric integration strategy. This necessitates prioritizing cultural due diligence from the earliest stages, implementing transparent and consistent communication across all levels, and proactively investing in strategic talent retention and knowledge management initiatives. By fostering an environment of trust, clarity, and belonging, you can mitigate the risks of cultural erosion and talent drain.

The goal is not to erase the past, but to thoughtfully blend the strengths of both entities, allowing the "soul" of your company to evolve and thrive in its new form. Prioritizing people ensures that the M&A journey leads not to a hollow shell, but to a stronger, more resilient, and truly integrated organization capable of realizing its full potential.

Next Steps

When you are thinking of selling your company or merging with another, and you are concerned about your legacy, your people, and your 'Earn-Out', we suggest you speak to us so we can discuss what matters most to you.

Contact us at The Pillars today.

(514) 505-3067

info@ThePillars.ca

Works Cited

- "Navigating SMB Mergers: Protecting Your Legacy, Your People, and Your Earn-Out" (uploaded file)

- "The M&A Failure Trap Newsweek," https://d.newsweek.com/en/file/476980/study-m-failure-trap.pdf

- "The importance of cultural integration in M&A: The path to success - McKinsey," https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-importance-of-cultural-integration-in-m-and-a-the-path-to-success

- "M&A_ Cultural Clash and Knowledge Loss_.docx" (uploaded file)"Seamless M&A Integration: Strategies for Success," https://www.kpintegrators.com/blog/ma-integration-strategies-for-success/

- "Tech M&A Failure Rates and Why Deals Fall Apart [Data Report] - WinSavvy," https://www.winsavvy.com/tech-ma-failure-rates-and-why-deals-fall-apart-data-report/

- "A Study of Cultural Integration in Corporate Merger and Expansion - Clausius Scientific Press," https://clausiuspress.com/assets/default/article/2024/12/24/article_1735029354.pdf

- "Employee Retention After Acquisition: 6 Strategies for Success," https://mnacommunity.com/insights/employee-retention-after-acquisition/

- "The Anatomy Of An Acquisition Failure: Why They Often Fail To Create Value," https://alejandrocremades.com/the-anatomy-of-an-acquisition-failure-why-they-often-fail-to-create-value/

- "M&A Impact on People and Culture - Travelers Insurance," https://www.travelers.com/resources/business-topics/business-risk/mergers-and-acquisitions-people-culture

- "The future of human capital in M&A: Why HR is key to success ...," https://www.deloitte.com/lu/en/our-thinking/future-of-advice/the-future-of-human-capital-in-m-and-a.html

- "What Happens to Employees During Mergers and Acquisitions?," https://smitheylaw.com/what-happensto-employees-during-mergers-and-acquisitions/

- "M&A: Tactical Strategies To Avoid Cultural Pitfalls - Forbes," https://www.forbes.com/councils/forbesbusinesscouncil/2023/03/13/ma-tactical-strategies-to-avoid-cultural-pitfalls/

- "Keeping Your Teams Engaged During Mergers and Acquisitions," https://www.pioneermanagementconsulting.com/insights/keeping-teams-engaged-during-mergers-acquisitions

- "Cultural issues in mergers and acquisitions - Deloitte," https://www2.deloitte.com/content/dam/Deloitte/us/Documents/mergers-acqisitions/us-ma-consulting-cultural-issues-in-ma-010710.pdf

- "Knowledge Management 101: Preventing a Knowledge Loss Crisis in 6 Steps - EDSI," https://www.edsi.com/blog/knowledge-management-101-preventing-a-knowledge-loss-crisis-in-6-steps

- "Integration of Artificial Intelligence and Project Management Techniques in Financial Restructuring - Digital Commons at Harrisburg University," https://digitalcommons.harrisburgu.edu/cgi/viewcontent.cgi?article=1079&context=dandt

- "Employee Retention Challenges: Strategies to Reduce Turnover - iSpring Solutions," https://www.ispringsolutions.com/blog/employee-retention-challenges

- "How to preserve your legacy when selling your business - Moneta Group,"

- https://monetagroup.com/how-to-preserve-your-legacy-when-selling-your-business

- "Cultural Strategies in M&As: Investigating Ten Case Studies - Digital ...," https://digitalcommons.kennesaw.edu/cgi/viewcontent.cgi?article=1031&context=jee

- "How to Retain Employees After a Merger or Acquisition - Sparkbay," https://sparkbay.com/en/culture-blog/retain-employees-merger-acquisition-44

- "Why post-merger integrations fail from a change and culture perspective," https://www.consultancy-me.com/news/10285/why-post-merger-integrations-fail-from-a-change-and-culture-perspective

- "Effect of Knowledge Acquisition on Organizational Performance - ResearchGate," https://www.researchgate.net/publication/378110844_Effect_of_Knowledge_Acquisition_on_Organizational_Performance

Caroline Samné - Author

Caroline Samné is a fluently bilingual Change Architect and leader of change. As co-founder of The Pillars, Caroline is passionate about equipping leaders with the skills they need to foster a human, change-enabled culture within their company. She is driven by a vision where all workplaces encourage people to thrive and become their best selves.

A big believer in social responsibility and giving back, Caroline acts as VP Students and Young Alumni for the Concordia Alumni Association. She mentors young women just starting their careers as well as those trying to set a path for themselves after completing their studies.

An advocate of education and as a a life-long learner herself, Caroline has been teaching part-time in the faculty of Applied Human Sciences at Concordia University since 2002.

Connect with Caroline on LinkedIn