The Soul of Your Business: Why Culture Isn't Just 'Soft Stuff' in M&A

Executive Summary

Selling the business you’ve poured your life into is more than just a transaction; it's about protecting a legacy and the people who helped you build it. You’ve probably heard those daunting statistics about M&A deals faltering—often, it’s because the “soft stuff,” like company culture, gets overlooked. This article dives into why cultural clashes are a silent threat, eroding the very identity you’ve painstakingly created and impacting your most loyal employees. We’ll explore the profound emotional toll this takes and shed light on your pivotal role in safeguarding your company's heart, ensuring that your life’s work truly thrives in its next chapter, and yes, directly protecting your financial earn-out.

As the founder of your company, you know deep down that your business isn't just a collection of assets or a balance sheet. It’s a living, breathing entity, shaped by decades of effort, a unique spirit, and the dedication of people you care about. When you think about selling, the numbers are important, of course, but what truly keeps you awake at night? It’s the fear that the vibrant culture you nurtured might be systematically paved over.

Remember Susan, your office manager of 25 years? She knows everyone's birthday, their coffee order, and keeps the office humming with her warm energy. You can almost see her, months post-acquisition, looking perpetually strained. The comfortable breakroom was replaced by sterile, modular pieces. The bulletin board, once a riot of team photos and inside jokes, now displaying cold, impersonal corporate policy updates. "Oh, boss… it’s… different now," she whispers, her voice hushed, eyes darting around as if afraid of being overheard. "They call our Friday morning coffee chats 'inefficient gatherings.' It’s like the color has been drained from the place. It feels like they're trying to erase every good memory, every piece of you." [3] That thought? It’s a knife to your heart, isn't it? It confirms your deepest fear: that the very soul of your company is at risk.

This isn't just a dramatic thought, my friend. This is the unseen, often unquantified, cost of mergers and acquisitions that falter.

I. The Heart of Your Business: More Than Just Numbers

When we talk about mergers and acquisitions (M&A), the conversation often buzzes with big, shiny numbers: economies of scale, market expansion, revenue boosts. And yes, those are absolutely important! But here's the kicker, and it’s something that likely keeps many founders like you up at night: roughly 70% of M&A deals don't actually hit those financial targets they set out to achieve [1]. It’s a paradox, isn’t it? All that strategic brilliance, all that financial wizardry, and still, so many deals fall short.

Why? Because the "soft stuff"—your people, your culture, the very soul of your company—turns out to be the hardest stuff to get right. In fact, challenges related to people, especially cultural clashes, are a pivotal factor, accounting for a staggering 30% of M&A integration failures [1]. It means that while the financial spreadsheets might get the deal done, the human element is what truly determines whether it thrives or falters.

For you, as the founder, this isn't just about a business transaction; it’s about your life's work. It’s about protecting everything you’ve poured yourself into. And here’s the direct line that matters most: by safeguarding your culture and retaining key talent, we directly help ensure the post-merger performance that secures your earn-out. [3] Your financial future, your legacy, and the well-being of your people are all intertwined. The truth is, the M&A world often gets caught up in the quantifiable, the "hard" numbers. But the consistent underestimation of cultural misalignment—what I call a "silent threat" [1]—persists until its negative consequences become undeniable.

II. When Cultures Collide: The Unseen Costs to Your Company's Soul

Cultural incompatibility is a frequently cited cause of M&A deals falling short, leading to significant lost value [4, 5]. It’s what happens when the philosophies, styles, values, and habits of two merging companies clash head-on [4]. And for you, as an SMB owner, this isn't just a corporate challenge; it’s a profound personal apprehension. The idea of your company's "soul" being systematically paved over, of familiar traditions being replaced by sterile, impersonal newness, is a fear that resonates deeply [3].

Think about it: cultural issues contribute to anywhere from 30% to 70% of integration failures [1]. Despite this well-documented impact, companies are "often surprised by the results of cultural due diligence" [4], and many (a staggering 58%!) don't even have a specific approach to assessing and integrating culture [2]. This tells us that cultural incompatibility truly is a "silent threat" [1] because it's consistently underestimated or poorly addressed. It’s not a lack of awareness, but a persistent failure to proactively manage these risks. This means your apprehension is far from irrational; it's rooted in a pervasive industry challenge.

Common Manifestations of Cultural Clashes

Cultural clashes show up in all sorts of ways, creating friction and undermining the very cohesion you're hoping for:

- Leadership Styles Conflict: Imagine your collaborative, open-door style meeting a hierarchical, top-down approach. Confusion, frustration, and even turnover can follow, especially among your top talent [5].

- Workplace Communication Styles: If your organization thrives on informal chats and quick decisions, a new entity that prefers formal emails and lengthy approval processes can lead to misunderstandings and inefficiencies [6].

- Approaches to Work-Life Balance: Your team might value flexible arrangements, while the acquiring company emphasizes strict schedules. This can demotivate employees and impact morale [6].

- Performance Metrics and Incentives: If your team thrives on craftsmanship and quality, and the new system focuses purely on numbers and mass production, it can create tension and a sense of being undervalued [6].

- Formation of Cliques and Distrust: In the uncertain post-deal environment, employees often retreat into "us vs. them" mentalities, seeking comfort with those who share their pre-merger norms [4].

- Continued Reference to Old Companies: A clear red flag is when your employees keep saying "the people from your company" instead of "our team." It signals a failure to establish a shared identity [4].

The Emotional Toll: Your People, Your Heart

The human impact of these clashes goes far beyond operational friction; it's a profound emotional toll. Nearly 70% of employees and 74% of leaders report significant stress and uncertainty after a merger [7]. This pervasive uncertainty, coupled with the feeling that the culture they cherished is disappearing, can lead to deep disengagement and a pervasive sense of identity loss [7].

Remember that imagined interaction with Susan? "It's like the color has been drained from the place... It feels like they're trying to erase every good memory, every piece of you." [3] This isn't just a dramatic thought; it captures the profound psychological impact. Long-term employees often have an unwritten "psychological contract" with their original company—a set of expectations around values, norms, and mutual obligations.

When the acquiring company imposes its culture, replacing familiar comforts with sterile newness, it feels like a fundamental breach of this agreement. This isn't just about job changes; it's about a perceived dismantling of their professional identity and the "soul" of the company they helped build. This profound psychological impact is a critical, often overlooked, driver of voluntary employee turnover, particularly among your most deeply embedded and loyal staff.

Your Role: The Founder as a Bridge and Champion

This M&A journey is a critical life event for you. You're not just a passive observer; you’re a pivotal figure, a bridge between the past and the future of your company. Your role in a human-centric integration is absolutely vital:

- The Trusted Voice: Your employees, especially those long-term team members, trust you more than anyone [8]. You've built relationships over decades. During this transition, you are their anchor. Your honest, empathetic communication about the changes, the "why" behind them, and your continued belief in their future will be invaluable [7].

- Champion of the New Culture: You've nurtured your company's culture like a garden. Now, you have the unique opportunity to champion the new, blended culture. This means actively participating in defining it, modeling the desired behaviors, and helping your team understand how the best of your organization will be woven into the new entity [5]. Your visible support can turn resistance into engagement.

- Bridge Between Old and New: You understand the nuances of your company's operations, its unspoken rules, and its unique "secret sauce." [9] You can translate between the old ways and the new, helping the acquiring company truly understand what made your organization special, and helping your team adapt to new systems and processes [10]. This is where your tacit knowledge becomes a superpower for integration.

- Advocate for Your People: Continue to be an advocate for your employees' well-being, their career paths, and their concerns. By working with the new leadership, you can ensure their voices are heard and their contributions are valued [7].

Your active involvement, especially during the integration phase, is a critical factor in ensuring a smooth transition, retaining key talent, and ultimately, securing your earn-out. Your presence and commitment send a powerful message: "I'm still here, I still care, and we're going to make this work, together."

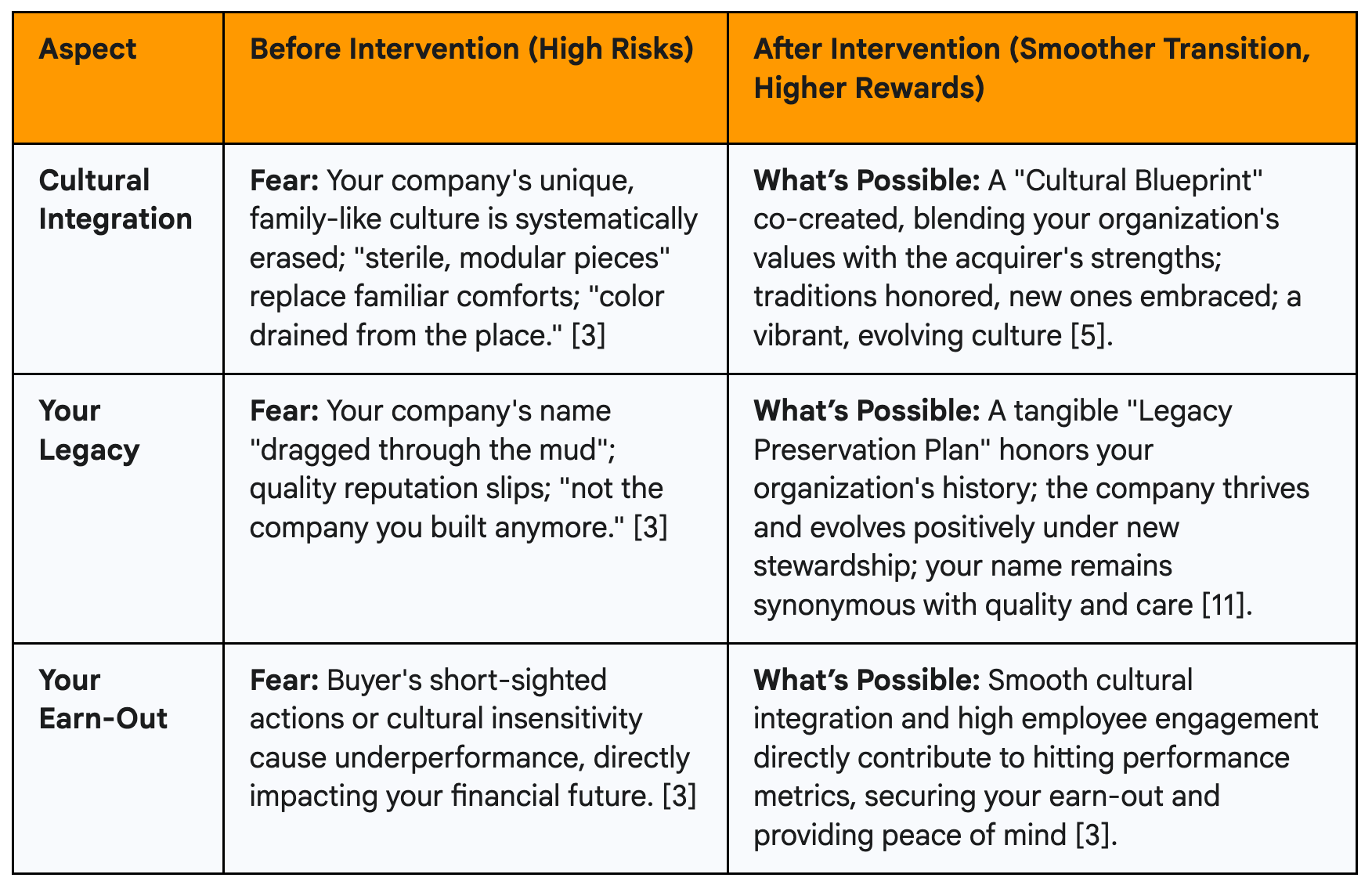

III. Your Company's Future: The Before & After of Cultural Care

Let's visualize the impact. This isn't just about abstract concepts; it’s about the tangible difference a human-centric approach can make for your company when it comes to culture:

Prioritizing cultural integration isn't just a "nice-to-have"; it's the very foundation upon which a successful M&A is built. It’s about protecting the heart and soul of what you’ve built, ensuring your legacy thrives, and ultimately, securing your future. In the next article, we’ll explore what happens when this foundation cracks: the silent exodus of experience and the invaluable "know-how" that walks out the door with your most cherished employees.

Next Steps

When you are thinking of selling your company or merging with another, and you are concerned about your legacy, your people, and your 'Earn-Out', we suggest you speak to us so we can discuss what matters most to you.

Contact us at The Pillars today.

(514)

Works Cited

- "The M&A Failure Trap | Newsweek," accessed June 18, 2025, https://d.newsweek.com/en/file/476980/study-m-failure-trap.pdf

- "M&A cultural integration: Best practices for a successful merger - Preply," accessed June 20, 2025, https://preply.com/en/blog/b2b-ma-cultural-integration/

- "M&A_ Cultural Clash and Knowledge Loss_.docx" (uploaded file)

- "Cultural issues in M&A — Financier Worldwide," accessed June 18, 2025, https://www.financierworldwide.com/cultural-issues-in-ma

- "Cultural issues in mergers and acquisitions - Deloitte," accessed June 18, 2025, https://www2.deloitte.com/content/dam/Deloitte/us/Documents/mergers-acqisitions/us-ma-consulting-cultural-issues-in-ma-010710.pdf

- "The 5 Most Common Culture Clashes in M&A | SVAC - SVA Consulting," accessed June 20, 2025, https://consulting.sva.com/insights/the-5-most-common-culture-clashes-in-ma

- "M&A Impact on People and Culture - Travelers Insurance," accessed June 20, 2025, https://www.travelers.com/resources/business-topics/business-risk/mergers-and-acquisitions-people-culture

- "How to Retain Employees After a Merger or Acquisition - Sparkbay," accessed June 20, 2025, https://sparkbay.com/en/culture-blog/retain-employees-merger-acquisition-44

- "Cracking the SMB playbook: Scaling through the leaky bucket," accessed June 20, 2025, https://www.scalevp.com/insights/cracking-the-smb-playbook-scaling-through-the-leaky-bucket/

- "The IT Services Merger," accessed June 20, 2025, https://www.it-services-merger.com/insights/successful-integration

- "How to preserve your legacy when selling your business - Moneta Group," accessed May 19, 2025, https://monetagroup.com/how-to-preserve-your-legacy-when-selling-your-business

Caroline Samné - Author

Caroline Samné is a fluently bilingual Change Architect and leader of change. As co-founder of The Pillars, Caroline is passionate about equipping leaders with the skills they need to foster a human, change-enabled culture within their company. She is driven by a vision where all workplaces encourage people to thrive and become their best selves.

A big believer in social responsibility and giving back, Caroline acts as VP Students and Young Alumni for the Concordia Alumni Association. She mentors young women just starting their careers as well as those trying to set a path for themselves after completing their studies.

An advocate of education and as a a life-long learner herself, Caroline has been teaching part-time in the faculty of Applied Human Sciences at Concordia University since 2002.

Connect with Caroline on LinkedIn